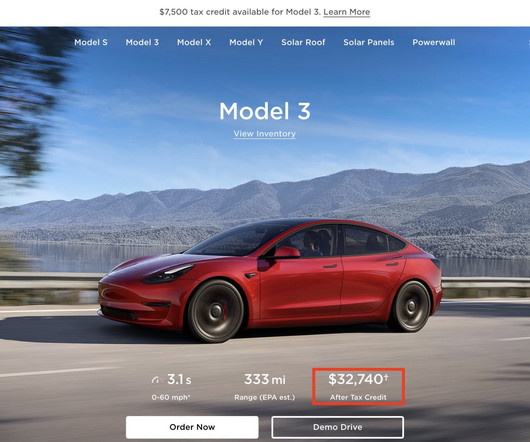

New Tesla Model 3 Performance with federal tax credit is more affordable than Long Range AWD

Teslarati

APRIL 24, 2024

With a starting price of $52,990, the reengineered Tesla Model 3 Performance is already a bang-for-the-buck vehicle. This is because among Tesla’s current Model 3 lineup, only the new Model 3 Performance qualifies for the $7,500 federal tax credit. There are few performance cars that can accelerate from 0-60 mph in 2.9

Let's personalize your content