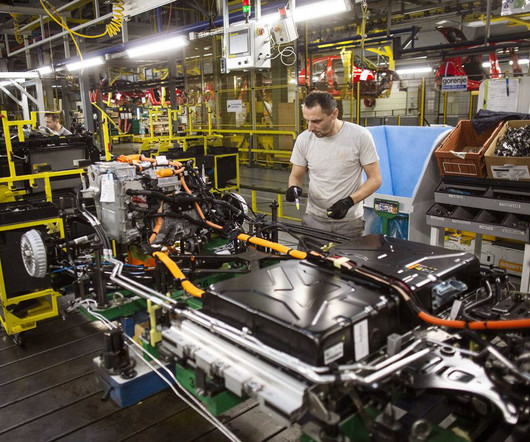

Thousands of auto dealers sign up to offer new on-the-spot tax credit

Electrek

DECEMBER 26, 2023

New year, new rules: As of January 1, things are about to get a little easier when it comes to getting your federal tax credit for buying an electric vehicle. And auto dealers are signing up in droves with the IRS. And auto dealers are signing up in droves with the IRS.

Let's personalize your content