The Honda Prologue Gets Major Boost with Federal Tax Credit Eligibility

The Truth About Cars

MARCH 6, 2024

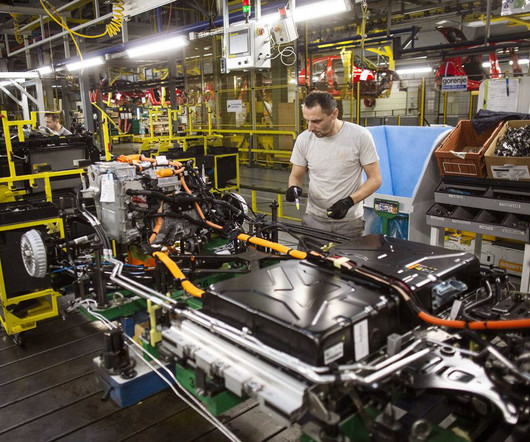

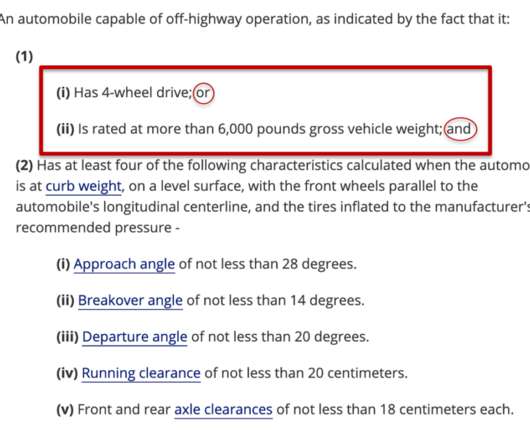

Honda leaned on General Motors to help get its EV program off the ground here in the U.S., The automaker recently announced that its upcoming Prologue EV would be eligible for federal tax credits of $7,500, meaning buyers can get around 15 percent off the SUV’s purchase price at the point of sale.

Let's personalize your content