Tesla Model 3 Highland leases qualify for IRA tax credit loophole

Teslarati

JANUARY 10, 2024

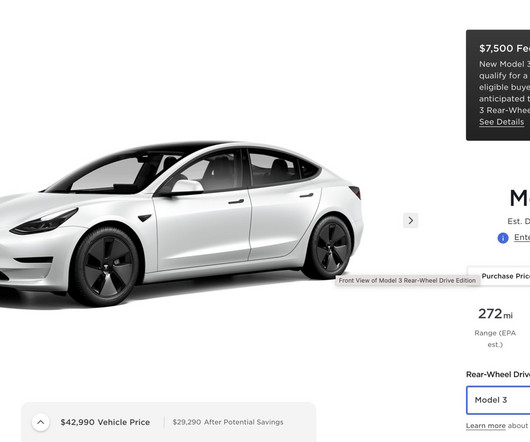

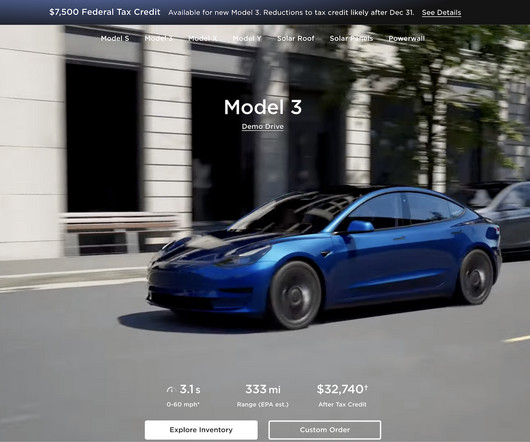

The Tesla Model 3 Highland was recently launched in North America. Tesla Model 3 Highland leases are more affordable thanks to a loophole in the Inflation Reduction Act about commercial vehicles. As customers scoured the updated Model 3 Highland configurator page, a few noticed that Tesla included a $7,500 incentive under leases.

Let's personalize your content