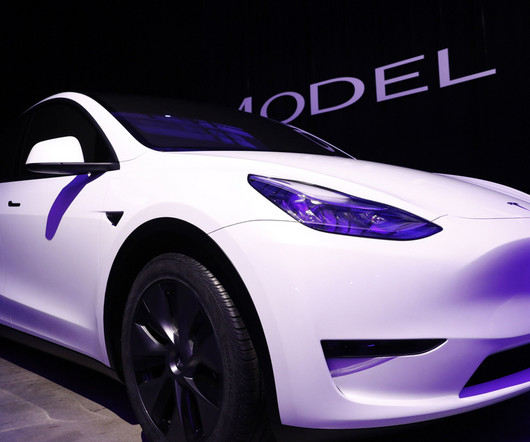

Which 2024 EVs qualify for the $7,500 EV tax credit?

Baua Electric

JANUARY 2, 2024

The list of electric vehicles qualified for the EV tax credit in calendar year 2024 has been released. And as anticipated by automakers in recent weeks, the Chevrolet Blazer EV and Cadillac Lyriq don’t yet make the list, while the Ford Mustang Mach-E is for now completely disqualified. And as expected, it’s very short.

Let's personalize your content