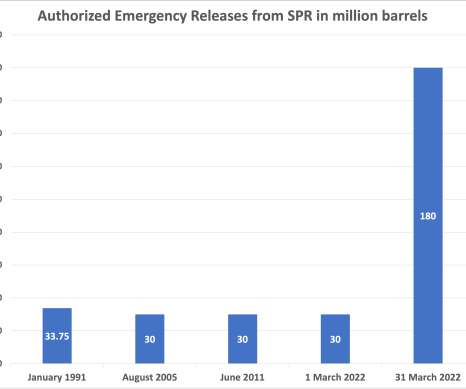

Biden authorizes release of more than 180M barrels of oil from Strategic Petroleum Reserve; 1M bpd for 6 months

Green Car Congress

APRIL 1, 2022

The US and other member states of the International Energy Agency (IA) agreed earlier in March to release 60 million barrels of oil reserves to compensate for supply disruptions following Russia’s invasion of Ukraine, with the US supplying 30 million. Test sales are relatively rare: the most recent test sale occurred in 2014.

Let's personalize your content