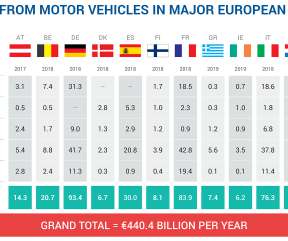

Motor vehicle taxation brings in €440.4B for governments in major European markets

Green Car Congress

MAY 4, 2020

New data shows that motor vehicles generate more than €440 billion in taxation per year for national governments in the major EU markets plus the UK, the European Automobile Manufacturers’ Association (ACEA) reports. The top 5 countries with the highest motor tax revenues are: Germany ? billion.

Let's personalize your content