T&E: Rising use of private jets sends CO2 emissions soaring

Green Car Congress

MAY 28, 2021

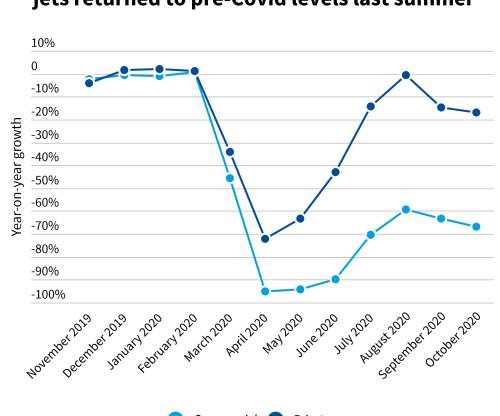

CO 2 emissions from private jets in Europe increased by nearly a third (31%) between 2005 and 2019, rising faster than commercial aviation emissions, according to a new report from environmental campaign group Transport & Environment (T&E). The report, Private jets: can the super-rich supercharge zero emission aviation?

Let's personalize your content