US COVID-19 mitigation efforts resulting in significant decline in traffic, emissions and fuel-tax revenues

Green Car Congress

MAY 2, 2020

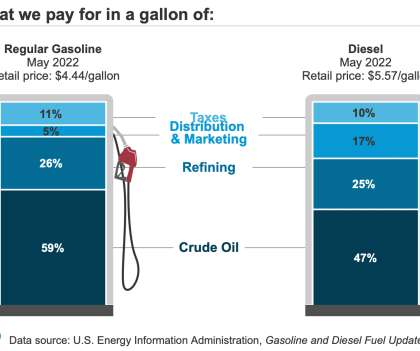

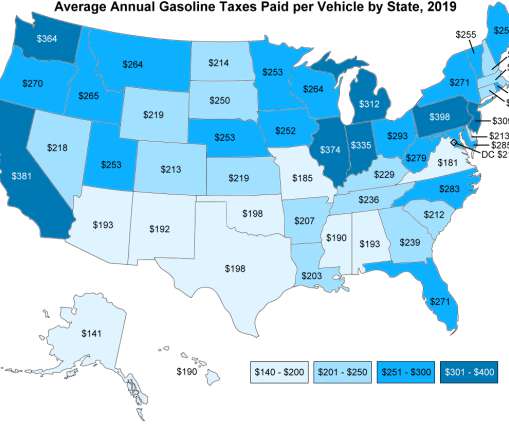

Fuel saved, tax revenue lost. Fuel use dropped from 4.6 It also resulted in fuel-tax revenue reductions, which vary by state. (UC Davis Road Ecology Center). billion gallons in early March to 1.3 billion gallons during the second week of April, saving US drivers $8.6 billion per week.

Let's personalize your content