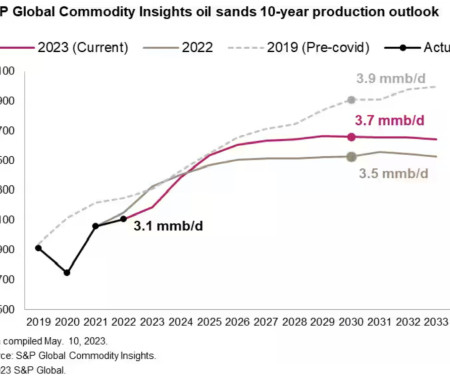

S&P Global Commodity Insights raises 10-year production outlook for Canadian oil sands

Green Car Congress

MAY 26, 2023

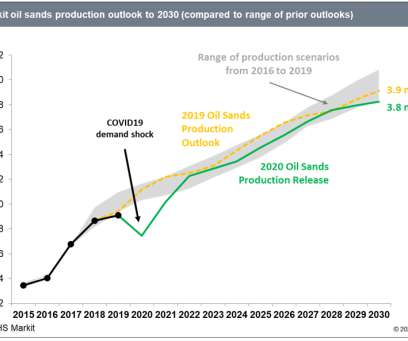

Higher crude prices and continued optimization improvements have driven the first upward revision to the S&P Global Commodity Insights 10-year oil sands production outlook in more than half a decade. Higher oil prices have driven record returns for the Canadian oil sands.

Let's personalize your content