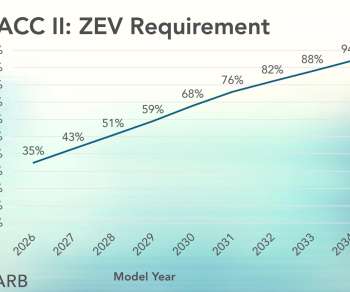

California ARB approves ACC II rule; 100% of LDVs to be PHEVS, ZEV by 2035; LEV IV emissions requirements

Green Car Congress

AUGUST 26, 2022

The California Air Resources Board approved the Advanced Clean Cars II (ACC II) rule. The rule establishes a year-by-year roadmap so that by 2035 100% of new cars and light trucks sold in California will be zero-emission vehicles (ZEVs) and plug-in hybrid electric vehicles (PHEVs). billion in fiscal year 2022-23, and $3.9

Let's personalize your content