Report: Tesla Model 3 Long Range All-Wheel Drive Could Become Eligible for EV Tax Credits

The Truth About Cars

JUNE 17, 2024

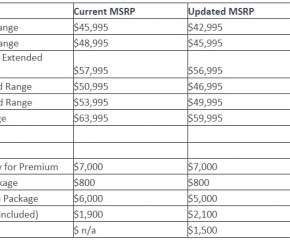

Tesla recently released the updated Model 3 sedan, but the refreshed model lost eligibility for federal tax credits in all but the top Performance trim. A handful of Reddit users are claiming that the situation has changed, however, stating that the Tesla app reflects the $7,500 credit for the Long Range All-Wheel Drive configuration.

Let's personalize your content