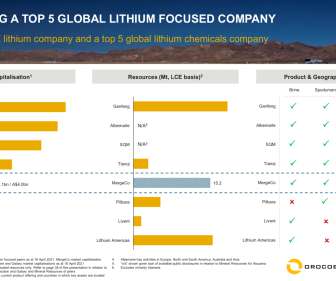

Orocobre and Galaxy to merge, creating 5th largest global lithium chemicals company

Green Car Congress

APRIL 24, 2021

A new name for the merged entity will be selected in due course representing the global reach of the new entity, which will have its head office in Buenos Aires, Argentina, a corporate headquarters on the Australian East Coast and an office in Perth. Upon implementation, Orocobre shareholders will own 54.2%

Let's personalize your content