Confused about the federal tax credit?

Electric Auto Association

FEBRUARY 7, 2023

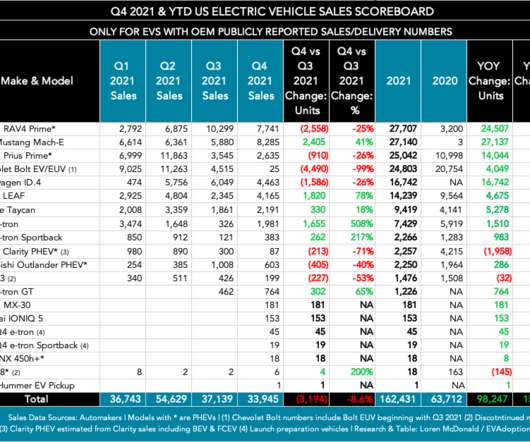

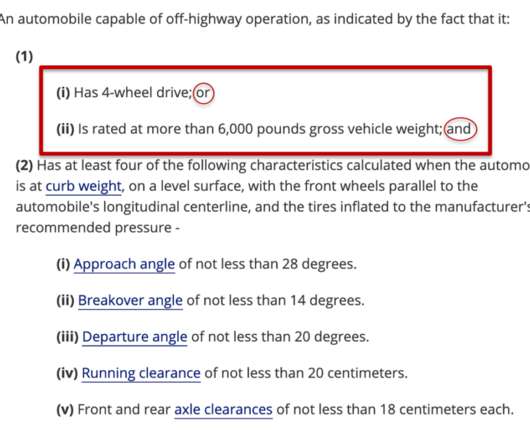

Know which EVs are eligible Chrysler Pacifica Plug-in Hybrid The Inflation Reduction Act of 2022 changed the rules for the US tax credit for electric vehicles (EV) purchased from 2023 to 2032.

Let's personalize your content