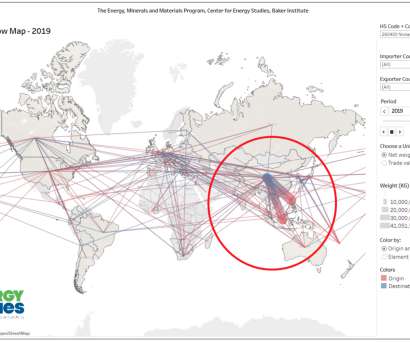

Baker Institute report: China has positioned itself as a gatekeeper to the energy transition; nickel case study

Green Car Congress

APRIL 21, 2022

Between 2010 and 2021, worldwide nickel usage grew almost 90%. There are also unanswered questions about how to even finance electrification or road construction and maintenance given lost revenues from fuels taxes, Foss said. This surge occurred mostly in China, driven by steel manufacturing.

Let's personalize your content