DOE publishes list of EVs eligible for new tax credit

Teslarati

AUGUST 17, 2022

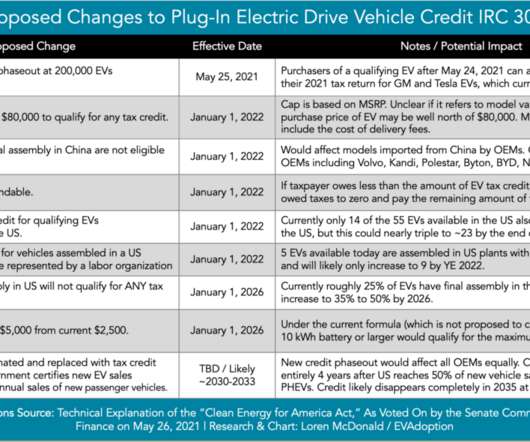

Department of Energy’s Alternative Fuels Data (DOE) published a list of electric vehicles that are immediately available for the new $7,500 EV tax credit. Under the new law, only EVs assembled in North America qualify for the credits. Tesla and GM were disqualified since both companies have sold over 200,000 EVs.

Let's personalize your content