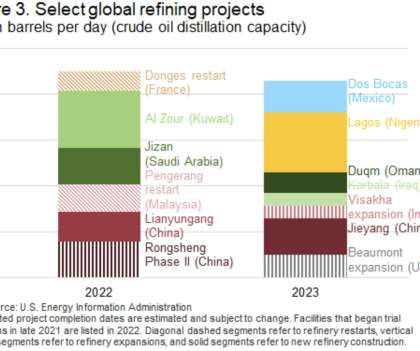

EIA: New refineries will increase global refining capacity in 2022 and 2023; China leads

Green Car Congress

JULY 21, 2022

High-capacity refineries require access to reliable sources of crude oil inputs to maintain higher utilization and to a sufficiently large pool of potential customers to supply. The refinery’s return is likely to decrease petroleum product prices and increase supply, particularly in south and southeast Asian markets.

Let's personalize your content