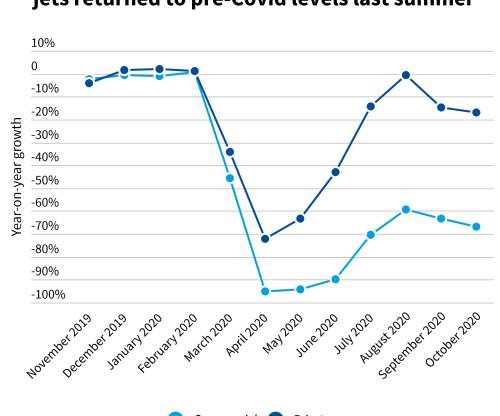

T&E: Rising use of private jets sends CO2 emissions soaring

Green Car Congress

MAY 28, 2021

finds that private jets are 10 times more carbon-intensive than airliners on average, and 50 times more polluting than trains in terms of CO 2 emitted per passenger-km. And yet, super-rich super polluters are flying around like there’s no climate crisis. The report, Private jets: can the super-rich supercharge zero emission aviation?

Let's personalize your content