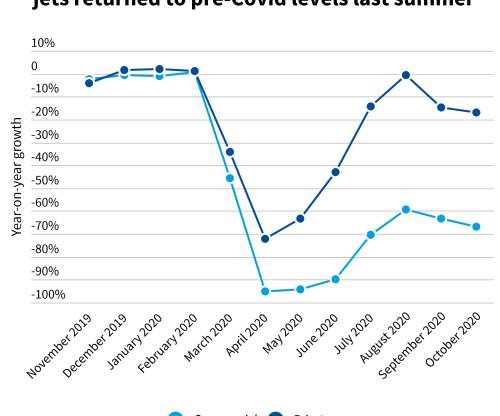

T&E: Rising use of private jets sends CO2 emissions soaring

Green Car Congress

MAY 28, 2021

CO 2 emissions from private jets in Europe increased by nearly a third (31%) between 2005 and 2019, rising faster than commercial aviation emissions, according to a new report from environmental campaign group Transport & Environment (T&E). Flying on a private jet is probably the worst thing you can do for the environment.

Let's personalize your content