How to Get the Federal Clean Vehicle Tax Credit This Year

Blink Charging

JANUARY 11, 2024

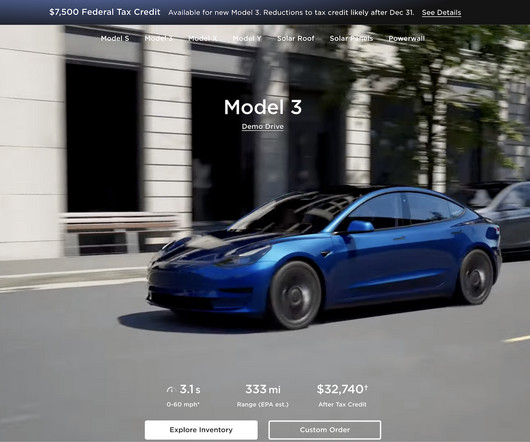

The United States federal government has made it even easier to buy a new or used electric vehicle (EV). The latest Clean Vehicle Tax Credits can be applied to the purchase of a new or used EV at the point of sale as of January 1, 2024. Here’s what you need to know.

Let's personalize your content