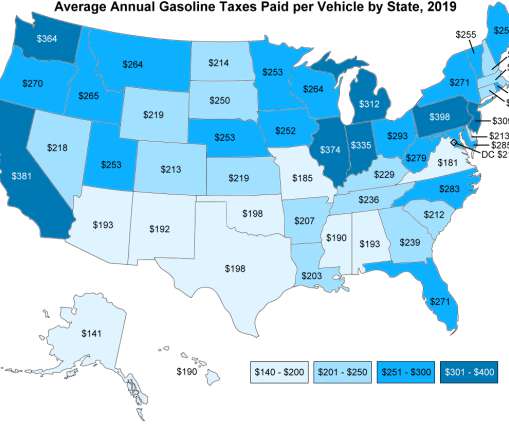

California Governor signs $52B fuel tax and vehicle fee bill for transportation infrastructure; $100 ZEV fee

Green Car Congress

APRIL 30, 2017

signed into law SB1 , the Road Repair and Accountability Act of 2017. billion over the next decade through an increase in fuel taxes and vehicle fees—including on zero emission vehicles (ZEVs)—to fix roads, freeways and bridges in communities across California and put more dollars toward transit and safety.

Let's personalize your content