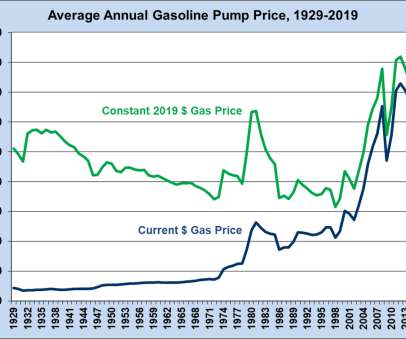

DOE: Adjusted for inflation, the price of gasoline in 2019 was similar to the price in 1929

Green Car Congress

DECEMBER 22, 2020

The average annual price of gasoline has fluctuated greatly over the past several decades, but when adjusted for inflation (constant dollars), the price of gasoline in 2019 was only nine cents higher than in 1929, according to the US Department of Energy (DOE). Note: Retail price includes Federal and State Taxes.

Let's personalize your content