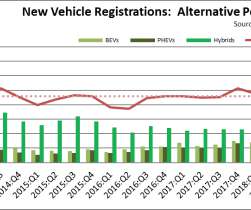

California cumulative PEV sales at 13.4% of 2030 goal; true ZEVs at 7.6%

Green Car Congress

FEBRUARY 26, 2020

Rather than only true ZEVs, the numbers in the Executive Order and previous interpretations by the agencies indicate the goal is to be achieved by both BEVs that run only on electricity and combustion PHEVs that run on both electricity and gasoline. of the 2030 goal, notes a new report from the California Center for Jobs & the Economy.

Let's personalize your content