It’s too late to China-proof the lithium supply chain – ET Auto

Baua Electric

MARCH 15, 2024

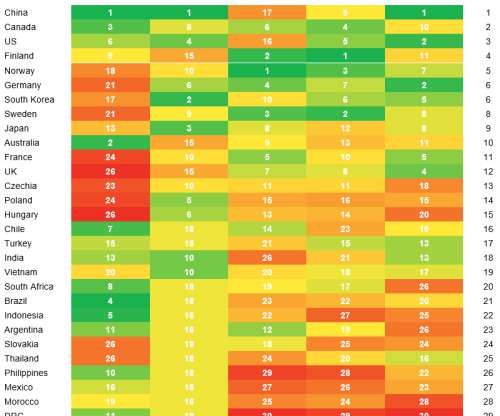

“Parts of our key supply chains, including for clean energy, are currently over-concentrated in China,” US Treasury Secretary Janet Yellen said earlier this month during a visit to Chile, home to the largest lithium reserves. The global lithium industry is so interwoven with Chinese capital now that it’s going to be impossible to unpick.

Let's personalize your content