Comment on Some battery makers in China to be forced to cut or halt production due to lack of orders, says TrendForce by DORAMAS

CN EV Post

DECEMBER 8, 2023

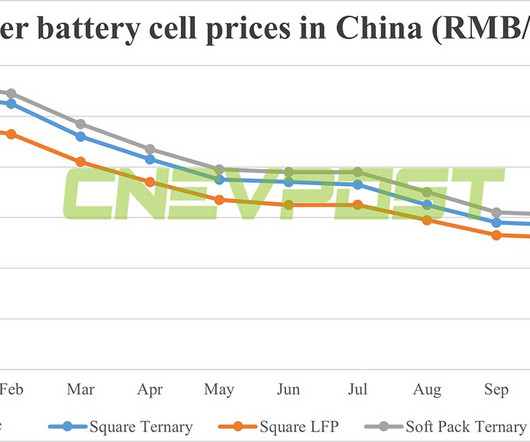

Demand is surging, its the supply side that is skyrocketing. All the mines in iran and Afghanistan going online what else would anyone expect. Contrary, battery demand wills shoot much since we have other reports here on cnevpost of projects still underway and new projects expanding across the world.

Let's personalize your content