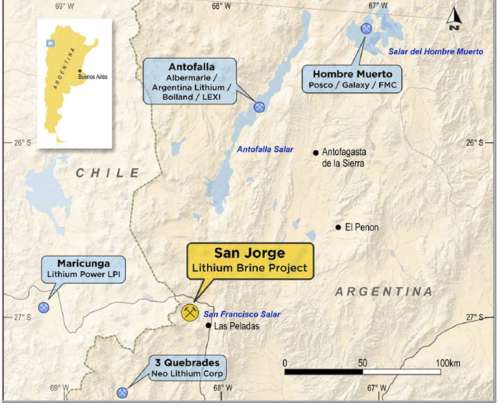

Bass Metals to acquire San Jorge lithium brine project in Argentina

Green Car Congress

MARCH 29, 2021

Along with Bass’ graphite assets in Madagascar, Bass considers the San Jorge project as a logical addition to its asset base and to its strategy to be an integrated supplier of both anode and cathode materials. Bass has exposure to both. —Rick Anthon, Chairman Bass Metals.

Let's personalize your content