ICCT report quantifies emissions benefits if 12 states & DC adopt slate of California medium- and heavy-duty vehicle regulations

Green Car Congress

NOVEMBER 1, 2021

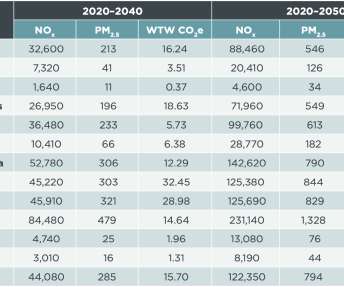

The ICCT defined six scenarios for analysis: Business as Usual (reflecting current Federal programs only, and non-implementation of the GHG Phase 2 trailer requirements). Dual Harmonization (California Advanced Clean Trucks Rule, Low-NOx Omnibus Rule w/urban buses) from model year (MY) 2025.

Let's personalize your content