Oversold Lithium could be about to rally

Green Car Congress

JANUARY 30, 2019

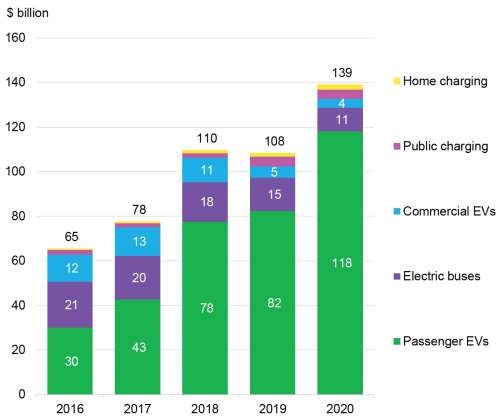

Shares of major lithium producers and explorers including Sociedad Química y Minera de Chile (NYSE:SQM), Albemarle Corp. Many Chinese brine producers in the Qinghai region had outlined plans to triple or quadruple capacities over the coming 3-4 years. Lithium carbonate prices will steady in 2019 before picking up steam starting 2020.

Let's personalize your content