Three Major Sources of Funding for EV Charging at Convenience Stores and Truck Stops

Blink Charging

AUGUST 22, 2023

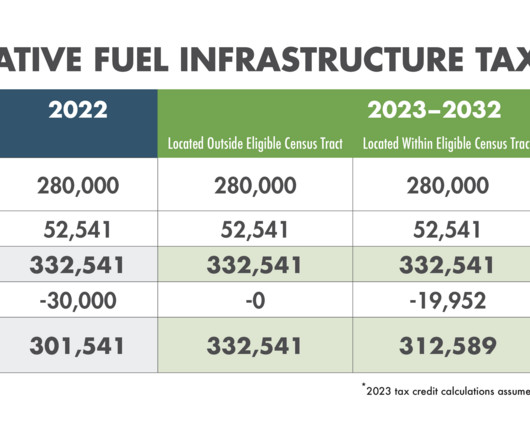

In the ongoing transition to electric vehicles (EVs), convenience stores and truck stops will continue to be important places for public EV charging. Businesses like convenience stores and truck stops are poised to take advantage of the current increase of EVs by installing public EV charging infrastructure. times more than in 2018.

Let's personalize your content