President Biden calls on Congress, States for fuel tax holiday; increase in refinery capacity

Green Car Congress

JUNE 23, 2022

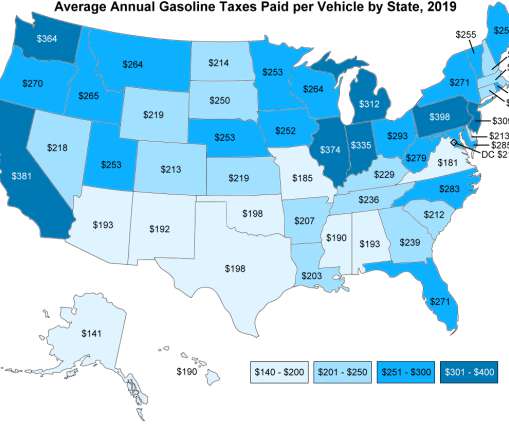

President Biden called on Congress to suspend the federal gas tax for the next 90 days, through the busy summer driving season—18 cents per gallon for gasoline and 24 cents per gallon for diesel. He also called on states to suspend their state gas taxes as well or to find other ways to deliver some relief.

Let's personalize your content