US COVID-19 mitigation efforts resulting in significant decline in traffic, emissions and fuel-tax revenues

Green Car Congress

MAY 2, 2020

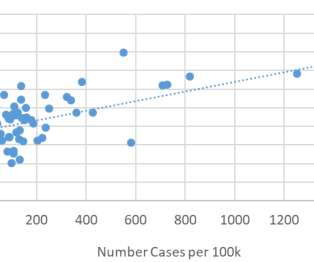

The authors used the VMT data to calculate that emissions of US greenhouse gas (GHG) emissions were reduced by 4% in total and by 13% from transportation in the almost 8 weeks since many stay-at-home orders went into effect. New York carried the highest rate of cases during the reporting period. Fuel saved, tax revenue lost.

Let's personalize your content