Spring is sprung in France

Push EVs

MAY 6, 2023

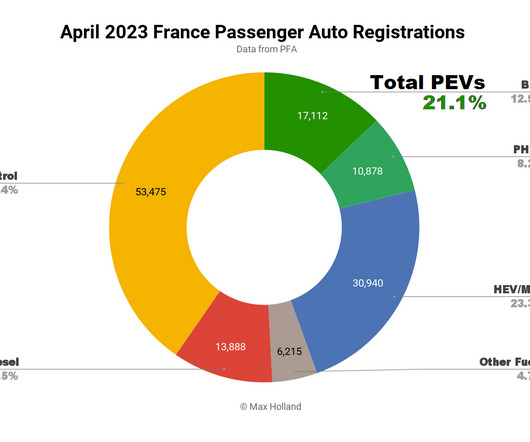

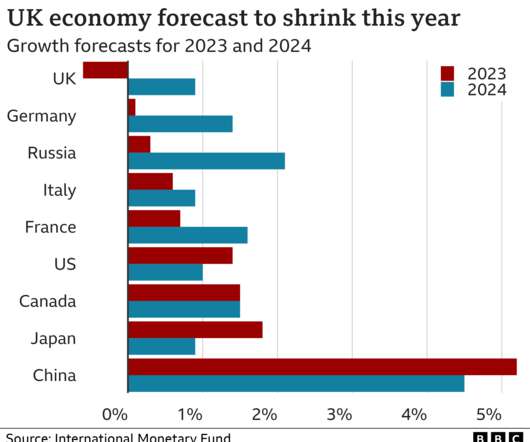

comprised full battery electrics (BEVs) at 12.9%, and plugin hybrids (PHEVs) at 8.2%. We can see that BEVs are still growing decently, whilst PHEVs are sliding. PHEVs only grew volume by 6% YoY (to 10,878 units), trailing broader market growth, and thus losing share. growth forecast for 2023.

Let's personalize your content