Luxurious new K1 SUV added to Porsche EV charge, Cayenne to go electric

EV Central

MARCH 14, 2023

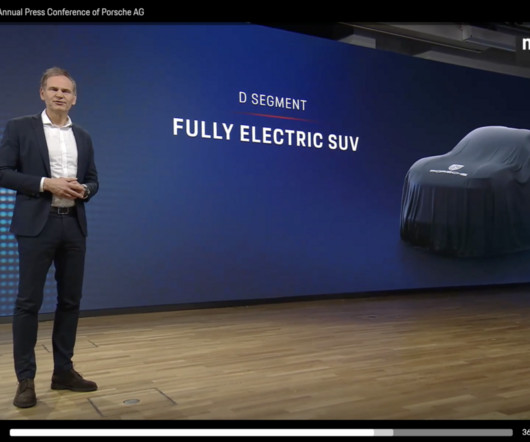

A luxurious new electric seven-seat SUV to sit above the soon-to-be-EV Cayenne SUV has been confirmed by Porsche as part of its increasingly electrified future model mix. Blume said the SUV would have significant sales growth potential in the China and the USA. The Panamera PHEV will also gain a larger battery pack.

Let's personalize your content