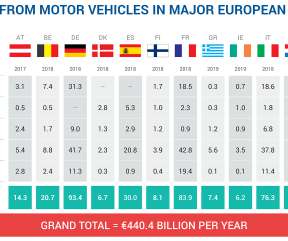

Motor vehicle taxation brings in €440.4B for governments in major European markets

Green Car Congress

MAY 4, 2020

The taxes fall into three broad categories: vehicle acquisition (VAT, sales tax, registration tax); ownership (annual circulation tax, road tax); and motoring (fuel tax). Motor tax revenues collected by governments have increased by almost 3% compared to the previous year, and the grand total of €440.4

Let's personalize your content