Your Guide to Electric-Vehicle Charging-Station Tax Credits

EV Connect

AUGUST 2, 2021

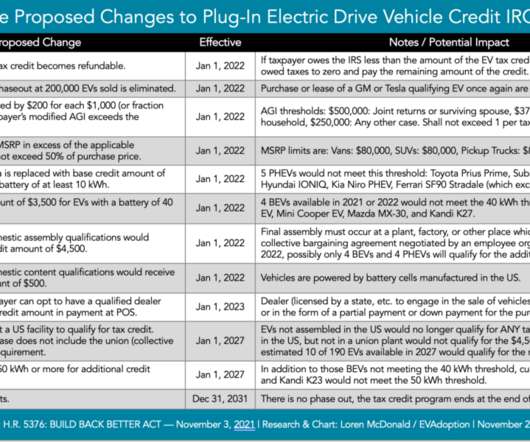

And thanks to a variety of tax credits and incentive programs, the barrier to entry may be lower than you think. On the federal, state and local levels, there are a plethora of tax credits for installing electric-vehicle charging stations. They include incentives for installing EV charging stations.

Let's personalize your content