Was the Jeep Wrangler 4xe 2021’s 3rd Highest-Selling EV in the US?

EV Adoption

JANUARY 22, 2022

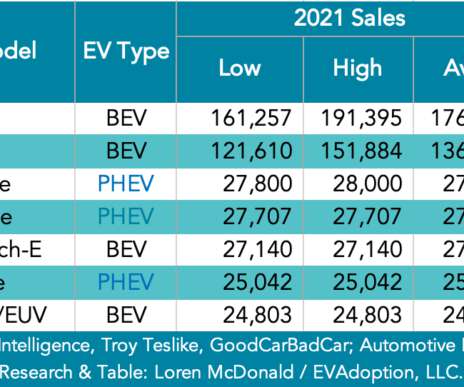

Only available in the US beginning in March of 2021, the hot-selling Jeep Wrangler 4xe plug-in hybrid electric vehicle (PHEV) was apparently the top-selling PHEV in the US last year. From where I sit, a new PHEV from Jeep outselling the Toyota RAV4 Prime is actually pretty impressive. Rocksteadyrobk, 4xeForums.

Let's personalize your content