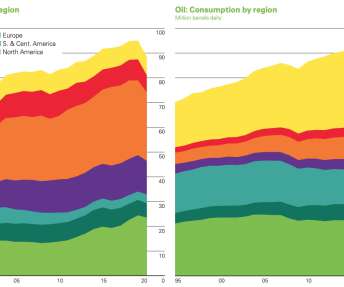

bp Statistical Review shows 4.5% drop in primary energy consumption in 2020; mainly driven by oil

Green Car Congress

JULY 12, 2021

The Review captures the significant impact the global pandemic had on energy markets and how it may shape future global energy trends. This fall was driven mainly by oil, which accounted for almost three quarters of the net decline. The oil price (Dated Brent) averaged $41.84/bbl bbl in 2020—the lowest since 2004.

Let's personalize your content