Fixing the Federal EV Tax Credit Flaws: Redesigning the Vehicle Credit Formula

EV Adoption

APRIL 4, 2021

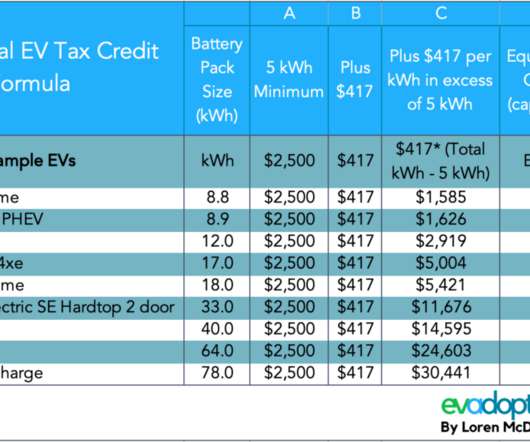

The Qualified Plug-In Electric Drive Motor Vehicles (IRC 30D) tax credit – commonly referred to as the “Federal EV tax credit” has a number of flaws, but one of the biggest is the poorly-designed formula that determines the amount of the tax credit available for each BEV and PHEV sold in the US.

Let's personalize your content