3 Scenarios That Would Make An EV Ineligible For the Federal EV Tax Credit

EV Adoption

NOVEMBER 29, 2021

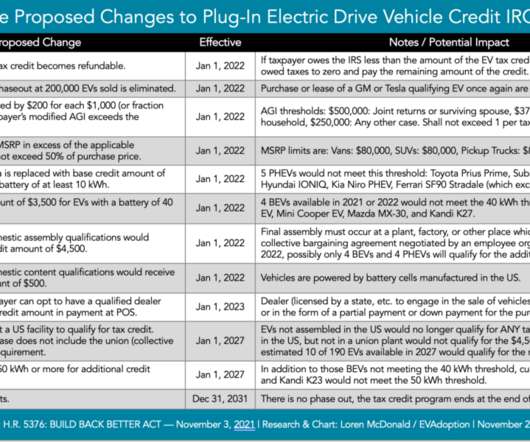

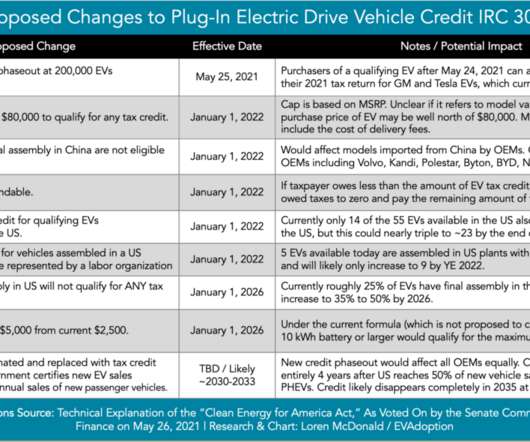

In my previous article, Proposed Changes to the Federal EV Tax Credit Passed by the House of Representatives , I outlined and analyzed 13 proposed changes to IRC 30D (federal EV tax credit). Battery is under 10kWh: Currently only five PHEVs would not meet the proposed 10 kWh threshold: Toyota Prius Prime (8.8

Let's personalize your content