Tesla stock climbs on tax credit inclusion, continuing stratospheric rise in 2023

Teslarati

FEBRUARY 3, 2023

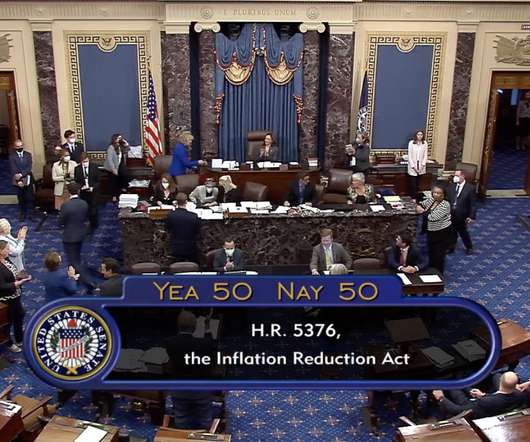

Tesla stock ( NASDAQ: TSLA ) continued to climb on Friday following news that Model Y vehicles would completely qualify for electric vehicle tax credits. may have been the deciding factor in the definition of an SUV being more widely available to vehicles that were on the cusp of qualifying.

Let's personalize your content