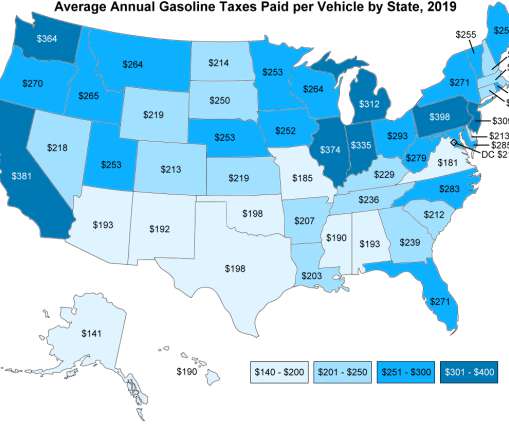

DOE: Average annual gasoline taxes paid per vehicle, by state, 2019

Green Car Congress

DECEMBER 3, 2019

miles per gallon (mpg) and the average annual miles driven is 11,484 miles. The Federal tax on gasoline is 18.4 cents per gallon, and each state has a gasoline tax, ranging from 8.95 Since taxes are charged on a per-gallon basis, someone with a more efficient vehicle will pay less in taxes over the course of a year.

Let's personalize your content