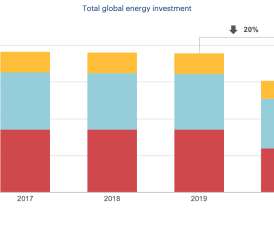

IEA: COVID-19 crisis causing the biggest fall in global energy investment in history

Green Car Congress

MAY 31, 2020

The COVID-19 pandemic has set in motion the largest drop in global energy investment in history, with spending expected to plunge in every major sector this year—from fossil fuels to renewables and efficiency—the International Energy Agency said in a new report. —Dr Birol.

Let's personalize your content