Don’t Worry If Your Favorite GM EV Doesn’t Qualify For A Federal Tax Credit

CleanTechnica EVs

JANUARY 5, 2024

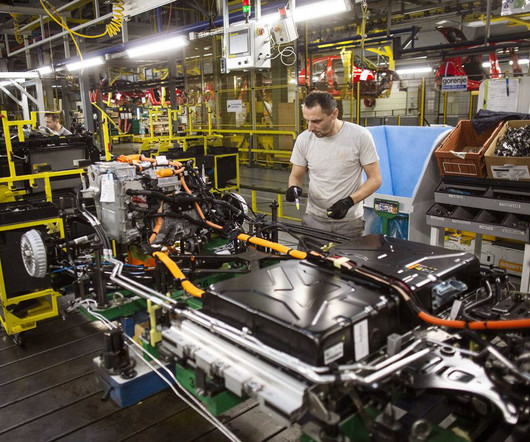

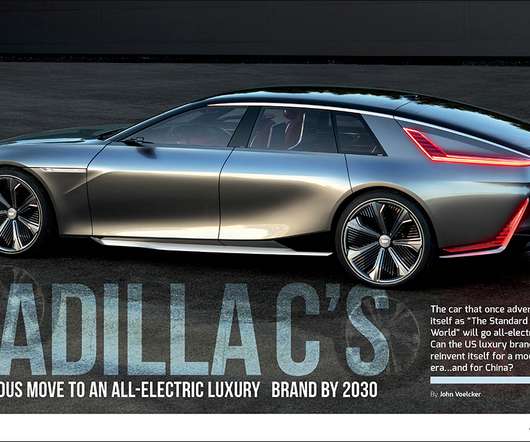

You’ve probably been frustrated this week if you were waiting for 2024’s cash rebate program to buy a General Motors. continued] The post Don’t Worry If Your Favorite GM EV Doesn’t Qualify For A Federal Tax Credit appeared first on CleanTechnica.

Let's personalize your content