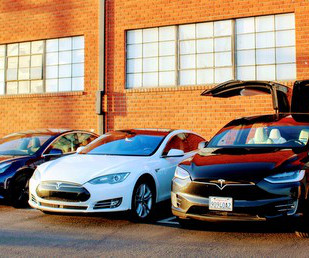

Changes in Store for the Massachusetts State EV Rebate Program

Green Energy Consumers

MAY 9, 2022

We have a whole page on our website to explain the federal tax credit (up to $7,500) and Massachusetts state rebate (MOR-EV) for electric vehicles (EVs). If you’re looking for an electric car, you are likely looking for rebates and incentives to help you make the switch too.

Let's personalize your content