Toyota will assemble Subaru 3-row EV in Kentucky, resources say

Baua Electric

AUGUST 1, 2023

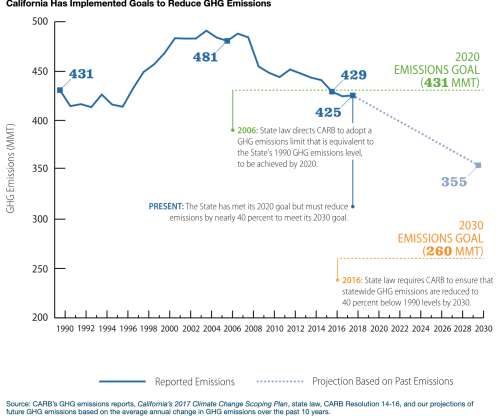

The general meeting location and battery sourcing would possibly permit each automobiles to qualify for the total $7,500 federal tax credit score for purchases underneath the Inflation Aid Business, which neither the bZ4X or Solterra do. which is scheduled to start out manufacturing in 2025.

Let's personalize your content