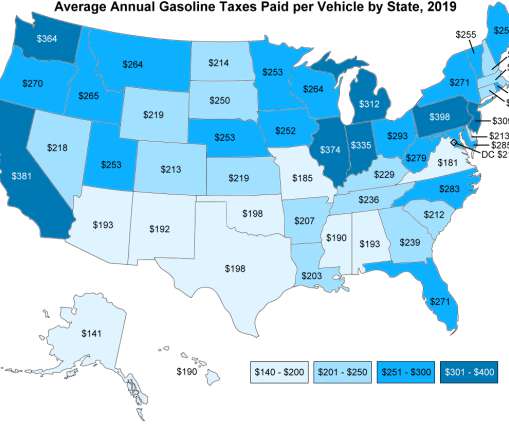

California Governor signs $52B fuel tax and vehicle fee bill for transportation infrastructure; $100 ZEV fee

Green Car Congress

APRIL 30, 2017

billion over the next decade through an increase in fuel taxes and vehicle fees—including on zero emission vehicles (ZEVs)—to fix roads, freeways and bridges in communities across California and put more dollars toward transit and safety. billion by increasing diesel sales tax to 5.75% on 1 November 2017.

Let's personalize your content