Will Higher Oil Prices Spark a Tesla Stock Surge?

CleanTechnica EVs

MARCH 22, 2022

As Ukraine weathers a continued Russian invasion, sanctions are causing high oil prices, resulting in high gas costs at the pump for consumers. Brent Crude oil […].

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

CleanTechnica EVs

MARCH 22, 2022

As Ukraine weathers a continued Russian invasion, sanctions are causing high oil prices, resulting in high gas costs at the pump for consumers. Brent Crude oil […].

Teslarati

FEBRUARY 25, 2022

Tesla’s ( NASDAQ: TSLA ) plans to expand its production capacity, along with other factors like surging oil prices that could sway consumers to electric vehicles, have contributed to Daiwa Securities analysts upgrading their outlook on the automaker’s stock.

Green Car Congress

DECEMBER 22, 2014

The collapse in world oil prices in the second half of 2014 will have only a moderate impact on the fast-developing low-carbon transition in the world electricity system, according to research firm Bloomberg New Energy Finance. However, the slump in the Brent crude price per barrel from $112.36 on 30 June to $61.60

Green Car Congress

DECEMBER 10, 2015

With OPEC breaking down and any kind of coordination among its members on price cuts looking increasingly unlikely, it now appears that oil prices could remain below $50 a barrel for a year or more. billion barrels of oil and 18.8 Mcf of natural gas. by Michael McDonald of Oilprice.com.

Green Car Congress

JANUARY 11, 2023

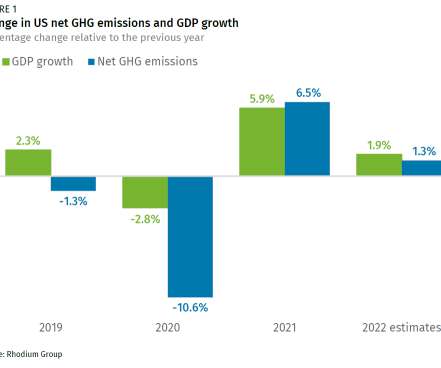

Despite efforts to continue stimulating the US economy in the wake of the pandemic, high inflation put a damper on economic growth, which was exacerbated by a spike in oil prices as a result of Russia’s invasion of Ukraine. Consequently, the US economy grew 1.9% in 2022, down from a 5.7% GDP increase in 2021.

Green Car Congress

DECEMBER 30, 2015

OPEC says that $10 trillion worth of investment will need to flow into oil and gas through 2040 in order to meet the world’s energy needs. The OPEC published its World Oil Outlook 2015 (WOO) in late December, which struck a much more pessimistic note on the state of oil markets than in the past.

Green Car Congress

OCTOBER 7, 2021

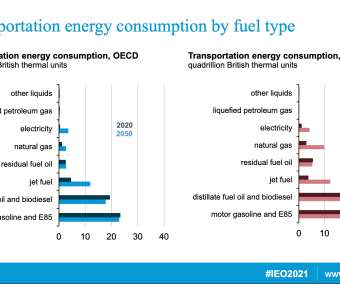

Renewables will be the primary source for new electricity generation, but natural gas, coal, and increasingly batteries will be used to help meet load and support grid reliability. EIA projects electricity generation to almost double in developing non-OECD countries by 2050. —Stephen Nalley.

Green Car Congress

NOVEMBER 24, 2010

A co-production scenario—yet to be commercial—would take unconverted syngas from the FT reactor and combust it in a combined cycle power plant to generate electricity that is sold to the grid. Plant-level CO 2 emissions can be greatly reduced by using the CCS technology, the study found, without much increase in capital cost.

Green Car Congress

FEBRUARY 2, 2015

The current plunge in oil prices will likely negatively affect plug-in and hybrid vehicle sales in the short term; automakers such as BMW are already warning of lower sales of plug-in vehicles given the market context. Anticipated price of oil and forecast plug-in sales. Lux on the price of oil.

Green Car Congress

APRIL 30, 2016

The study was commissioned by a coalition of fuel suppliers and automotive companies with a view to identifying a roadmap to 2030+ to identify GHG abatement options at the lowest cost to society. GHG abatement in road transport sector will cost approx. PHEVs fueled with advanced biofuels and low carbon, renewable electricity (for PC).

Green Car Congress

JANUARY 17, 2015

The cost of generating power from renewable energy sources has reached parity or dropped below the cost of fossil fuels for many technologies in many parts of the world, according to a new report released by the International Renewable Energy Agency (IRENA). Real weighted average cost of capital is 7.5% Source: IRENA.

Green Car Congress

APRIL 14, 2015

The Annual Energy Outlook 2015 (AEO2015) released today by the US Energy Information Administration (EIA) projects that US energy imports and exports will come into balance—a first since the 1950s—because of continued oil and natural gas production growth and slow growth in energy demand. With greater U.S.

Green Car Congress

JULY 5, 2016

Whereas fuel cost used to be a major driver for fleet managers, the lowering of oil prices and the availability of low-cost natural gas has reduced this concern, Navigant notes. A major factor has always been the cost of battery packs. —“ Medium and Heavy Duty Vehicle Technologies ”.

Green Car Congress

APRIL 7, 2021

EIA also forecasts the Brent crude oil price will average $64 per barrel this summer, a 78% increase from last summer’s average of $36 per barrel. That price increase paired with an increase in gasoline and diesel demand will likely increase the cost of regular gasoline and diesel fuel this summer. MMBtu in 2020 to $3.31/MMBtu

Green Car Congress

JUNE 19, 2012

GE has concluded a commercial alliance agreement with Norway-based Sargas AS to provide a gas turbine for one of the world’s first gas-fired plants with integrated carbon capture for enhanced oil recovery (EOR). GE’s LMS100 turbine is a combination of proven frame and aero-derivative gas turbine technology.

Green Car Congress

DECEMBER 5, 2012

Sales of battery-powered electric vehicles are 65% lower in the AEO2013 Reference case than the year before, with annual sales in 2035 estimated to be about 119,000. Reductions in battery electric vehicles are offset by increased sales of hybrid and plug-in hybrid vehicles, which grow to about 1.3 million, or less than one-half the 2.9

Green Car Congress

DECEMBER 13, 2017

Gevo and LANL are looking to develop a low-cost, catalytic technology that would be bolted-on to Gevo’s existing isobutanol-to-hydrocarbons process to produce high energy density fuels (HEDFs). HEDFs are currently used in air and sea-launched cruise missiles used by the US military forces.

Green Car Congress

JULY 12, 2011

According to a recently published report commissioned by the Victoria (Australia) Department of Transport from AECOM, electric vehicle (EV) technology offers the state of Victoria potentially significant economic benefits by the late 2020s. most consumers, according to the report. most consumers, according to the report. Scenario 1.

Green Car Congress

SEPTEMBER 13, 2017

At home, the kingdom needs oil and natural gas for transportation, industrial production and electricity generation. Each of these sources of domestic demand is increasing, propelled by rising populations, growing incomes and subsidized end-user prices that, despite a recent adjustment, remain among the lowest in the world.

Green Car Congress

NOVEMBER 27, 2011

Technically feasible levels of energy efficiency and decarbonized energy supply alone will not be sufficient to reduce greenhouse gas emissions 80% below 1990 levels by 2050, according to a detailed modeling of the California economy performed by a team from Energy and Environmental Economics, the Monterey. Williams et al. Click to enlarge.

EV Connect

JULY 5, 2022

For many drivers there is a basic understanding of how traditional gasoline pricing functions: Oil prices based on availability and proximity in large part dictate how much a driver will pay at the pump. Pricing at a Glance Charging up your electric car at home sets a pricing baseline.

Green Car Congress

JANUARY 23, 2012

EIA’s AEO2012 projects a continued decline in US imports of liquid fuels due to increased production of gas liquids and biofuels and greater fuel efficiency. EIA added a premium to the capital cost of CO 2 -intensive technologies to reflect current market behavior regarding possible future policies to mitigate greenhouse gas emissions.

Green Car Congress

NOVEMBER 11, 2010

BCG’s analysis finds that cellulosic ethanol is on the verge of becoming cost-competitive with gasoline at $3/gal US. The costs of these alternative energy technologies are falling rapidly, and they are on the path to becoming cost-competitive within the next five to ten years, if not sooner. Click to enlarge.

Green Car Congress

MARCH 8, 2009

integrating biological and thermochemical processing to produce biofuels and/or power could offer similar, if not lower, efficiencies and costs and very large reductions in greenhouse gas emissions compared to petroleum-derived fuel, according to a comparative analysis of 14 mature technology biomass refining scenarios. GTCC power.

Green Car Congress

JUNE 7, 2017

A new study by researchers at the University of Colorado at Boulder projects the emission impacts of the widespread introduction of inexpensive and efficient electric vehicles into the US light duty vehicle (LDV) sector. The work is reported in a paper in the ACS journal Environmental Science & Technology. —Keshavarzmohammadian et al.

Green Car Congress

JANUARY 13, 2011

The transportation sector thus represents a significant fraction of total greenhouse gas (GHG) emissions both globally and in the US—light-duty vehicles (LDVs) are responsible for 17.5% Electrification will also reduce oil dependence, providing foreign policy benefits and the potential to reduce real oil prices and oil price volatility.

Green Car Congress

MAY 11, 2010

General Motors and Hawaii’s The Gas Company (TGC), the state’s major gas energy provider, are collaborating on a hydrogen infrastructure project. Fuel prices are among the highest in the US. Electricity costs are the highest in the US. TGC infrastructure follows the populated core on Oahu. Click to enlarge.

DIY Electric Car

NOVEMBER 28, 2010

There have been 5 recession since then until now and I wanted to see if Oil had anything to do with them, because deep in my heart, I knew the most recent recession was directly caused by the oil price spikes that started in 2007 and peaked in 2008. OPEC quadrupled the price of oil and the US quickly fell into recession.

Green Car Congress

DECEMBER 16, 2013

Greenhouse gas (GHG) emission standards and CAFE standards increase new LDV fuel economy through model year 2025 and beyond, with more fuel-efficient new vehicles gradually replacing older vehicles on the road and raising the fuel efficiency of the LDV stock by an average of 2.0% per year, from 21.5 l/100 km) in 2012 to 37.2

Green Car Reports

FEBRUARY 8, 2016

The cost of a barrel of oil is now just a fraction of what it was several years ago, and fuel prices have mostly fallen across the globe as a result. Oil prices rise and fall, but most industry analysts suggest that the emergence of North American production has loosened OPEC's ability to set prices unilaterally.

Green Car Congress

JANUARY 29, 2014

DNV and GL merged in September 2013 to form DNV GL—the world’s largest ship and offshore classification society, the leading technical advisor to the global oil and gas industry, and a leading expert for the energy value chain including renewables and energy efficiency. —“Alternative Fuels for Shipping”.

Green Car Congress

MAY 15, 2012

Performance in the study is measured by such metrics as: (1) required selling price of the fuel; (2) crude oil price when the process will become economically viable; (3) the Well-to-Wheels (WTW) life cycle GHG emissions profile of the diesel fuel; and (4) the water usage associated with the facility. —White and Gray.

Green Car Congress

APRIL 10, 2009

A new study by the French institute Enerdata, commissioned by the European Federation for Transport & Environment (T&E), suggests that the European CO 2 standards for new vehicles due to come into effect in 2012 will lead not only to a European savings on oil (mainly via lower oil import volumes) but also to slightly lower global oil prices.

Green Car Congress

OCTOBER 17, 2009

World production of fossil fuels—oil, coal, and natural gas—increased 2.9% million tons of oil equivalent (Mtoe) per day, according to a Worldwatch Institute analysis. Nonetheless, high oil prices pushed production from the Canadian oil sands to 1.2 Total gas production grew 3.8% in 2008 to reach 27.4

Green Car Congress

FEBRUARY 15, 2012

The KPMG study, “Expect the Unexpected: Building Business Value in a Changing World”, explores issues such as climate change, energy and fuel volatility, water availability and cost and resource availability, as well as population growth spawning new urban centers. Source: KPMG. Click to enlarge.

Green Car Congress

JANUARY 18, 2010

The study found that for small and medium passenger vehicles, expected lifetime cost per kilometer for EVs is already lower than that of conventional ICE. The total cost of ownership includes the vehicle price, annual fuel and maintenance costs and insurance. Future costs have been discounted at 7%. Source: AECOM.

Green Car Congress

SEPTEMBER 28, 2011

The DOE-QTR defines six key strategies: increase vehicle efficiency; electrification of the light duty fleet; deploy alternative fuels; increase building and industrial efficiency; modernize the electrical grid; and deploy clean electricity. DOE’s most significant role in transport research is here.

Green Car Congress

DECEMBER 17, 2010

Shale gas offsets declines in other US supply to meet. The Annual Energy Outlook 2011 (AEO2011) Reference case released yesterday by the US Energy Information Administration (EIA) more than doubles the technically recoverable US shale gas resources assumed in AEO2010 and added new shale oil resources. Source: EIA.

Green Car Congress

MAY 12, 2011

Energy executives expect continued volatility in the price-per-barrel of oil for the remainder of the year, with 64% predicting crude prices to exceed $121 per barrel. Increased production of shale gas in North America could have profound implications on the global energy sector. Alternative energy sources.

Green Car Congress

NOVEMBER 7, 2010

Kreutz presented the paper at the 10 th International Conference on Greenhouse Gas Control Technologies ( GHGT-10 ) earlier this fall in The Netherlands. In the near-term pre-CCS era, with a low cost of carbon, the economical solution for power providers is to vent the CO 2 and pay the fees, passing on the costs to customers.

Green Car Congress

AUGUST 15, 2010

Examples of emerging oil sands related technologies and trade-offs. The paper is an examination of how various choices about the scale of the life cycle analysis applied to oil sands (i.e., A growing supply of unconventional transportation fuels would tend to moderate oil prices and would drive up emissions on a life cycle basis.

Green Car Congress

NOVEMBER 25, 2009

Gas Conditioning. Projected output of the Clinton Project is a maximum 13,000 barrels of diesel per day (15,800 barrels of oil equivalent per day or 5.3 Syngas projects about a 10% ROI at US$60/barrel of crude, which higher returns at higher oil prices. Budget Level Cost Estimates for the FT Unit.

Green Car Congress

NOVEMBER 12, 2012

The WEO finds that the extraordinary growth in oil and natural gas output in the United States will mean a sea-change in global energy flows. In the New Policies Scenario, the WEO ’s central scenario, the United States becomes a net exporter of natural gas by 2020 and is almost self-sufficient in energy, in net terms, by 2035.

Green Car Congress

JULY 14, 2009

In two other scenarios considered, a high oil price scenario (using EIA projections) and a battery swap operator-subsidzied scenario, EV new vehicle sales penetration reaches 85% and 86% respectively by 2030. Electric Cars in the United States: A New Model with Forecasts to 2030” was written by Thomas Becker, a Ph.D.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content