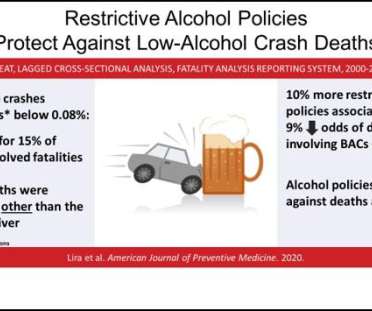

Study: 15% of US alcohol-related motor vehicle fatalities involve alcohol under the legal limit

Green Car Congress

MARCH 17, 2020

A new open-access study in the American Journal of Preventive Medicine found that motor vehicle crashes involving drivers with blood alcohol concentrations (BACs) below the legal limit of 0.08% accounted for 15% of alcohol-involved crash deaths in the United States. Lira et al. In 2018, Utah became the first state to do so.

Let's personalize your content