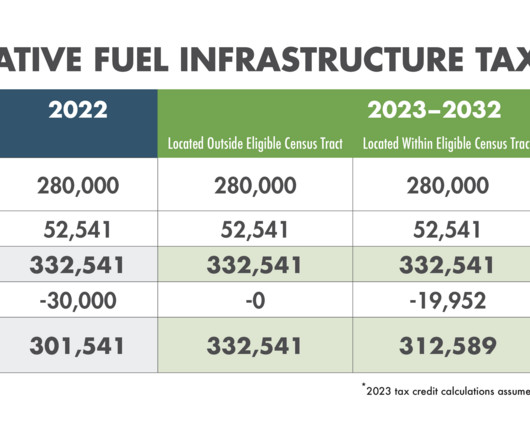

Deep Dive into the Alternative Fuel Infrastructure Tax Credit in 2022 and 2023

Blink Charging

MARCH 1, 2023

The Section 30C Alternative Fuel Vehicle Refueling Property Infrastructure tax credit expired at the end of 2021; however, with the passage of the Inflation Reduction Act of 2022, the program was renewed for another 10 years with a few caveats. Learn more about the EV tax credit.

Let's personalize your content