Kia EV9 reservations to start this month in North America

Teslarati

OCTOBER 6, 2023

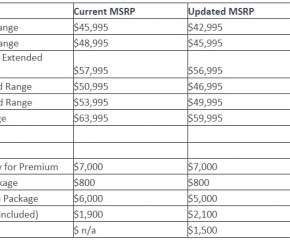

Kia EV9 reservation will start this month in North America. The South Korean automaker recently announced that North American customers may start reserving the three-row EV9 SUV on October 16, 2023, at 10 a.m. market in years,” said COO & EVP of Kia America Steven Center. “As One year of digital features and services.

Let's personalize your content